Buyers

What Does Express Title Services Do?

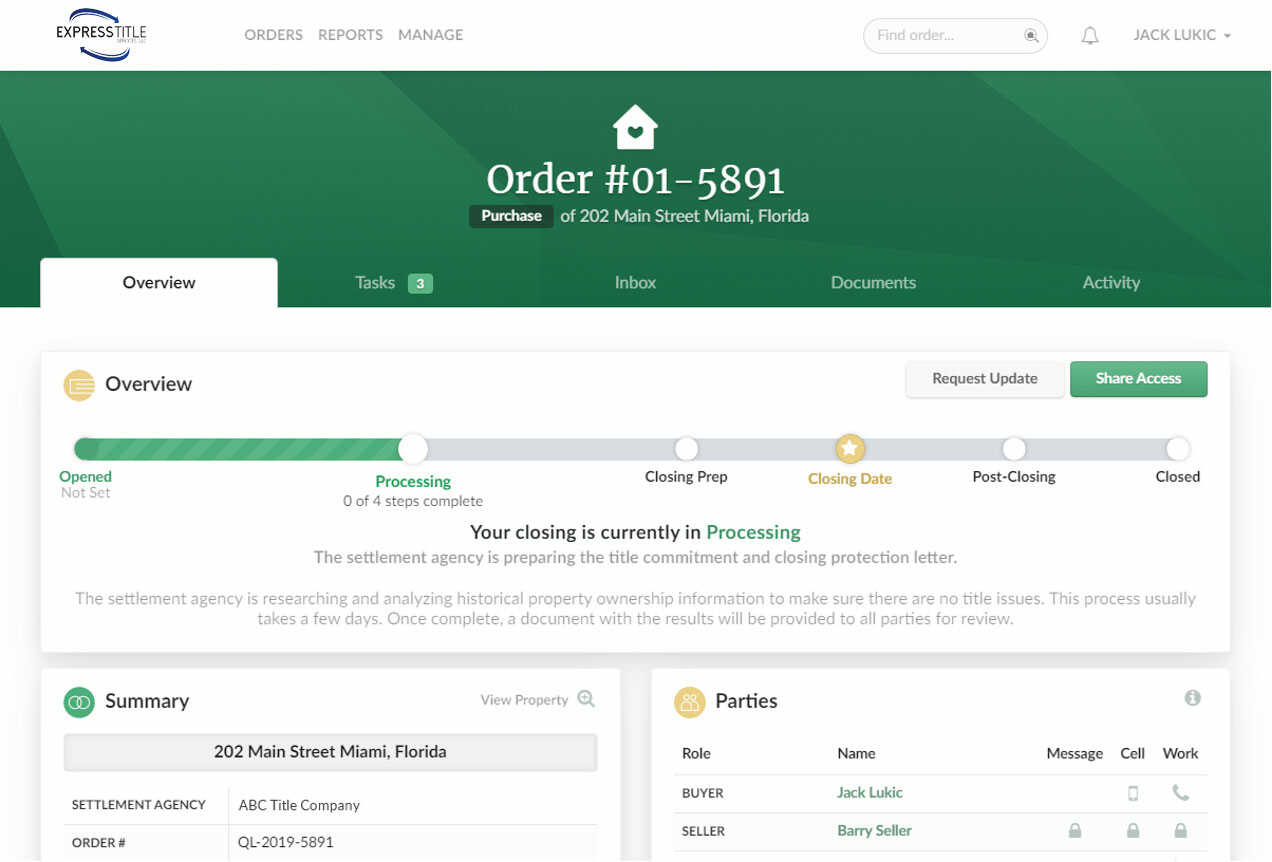

Our unique closing process is thoroughly detailed below. In a nutshell, Express Title Services, LLC is your guide from contract through closing that makes sure that you, as the buyer, are getting clean title to the property you’re purchasing while providing detailed status updates at each stage of the process.

Further, our attorneys ensure the legal requirements in transferring ownership of a property to you are met by the seller, which only an attorney-owned and operated title company is able to do. We’re available to answer legal contract questions should they arise prior to signing.

What Does Express Title Services Do?

Our unique closing process is thoroughly detailed below. In a nutshell, Express Title Services, LLC is your guide from contract through closing that makes sure that you, as the buyer, are getting clean title to the property you’re purchasing while providing detailed status updates at each stage of the process.

Further, our attorneys ensure the legal requirements in transferring ownership of a property to you are met by the seller, which only an attorney-owned and operated title company is able to do. We’re available to answer legal contract questions should they arise prior to signing.

Immediately upon receipt of a contract,

the process begins:

- Your file is assigned to a dedicated closing coordinator, allowing for a streamlined process.

- An introductory email is immediately sent out to all parties outlining the critical dates and deadlines remaining in the transaction. The email is accompanied by electronic calendar reminders, to ensure no deadline, such as making a deposit or obtaining loan approval is missed.

- We’ll verify all deposits are timely made, and send a letter verifying so to all parties.

- We immediately perform a title search, determining if there are any liens, mortgages, or title defects on the property. If there are, our legal team begins resolving them.

- If the buyer is obtaining a loan, we immediately work with the lender to provide them the documentation they need to approve the financing, avoiding delays in the closing.

- If the property is in a condo or homeowners association, we’ll immediately contact the association to determine the property is in good standing. For instance, all maintenance fees are current.

- Our legal team will review all documents prepared by the seller’s attorney, such as the deed, to ensure all legal requirements are satisfied. If the seller does not have an attorney, we can prepare the documents for them.

- We prepare the final closing statement, which is an explanation of closing costs, and is similar to preliminary closing statements you’ll have already seen throughout the transaction. Our legal team reviews the closing statement to ensure proper allocation of closing costs amongst the parties prior to our review and thorough explanation of all costs with the buyer.

- Final closing is scheduled at any of our offices or wherever is most convenient for the client.

- At closing, all documents are thoroughly explained. Any liens or title defects have now been cured and a final title insurance policy is issued protecting the buyer.

- Before, during, and after closing we are here and always available to answer questions or assist in any way we can.

Immediately upon receipt of a contract, the process begins:

- Your file is assigned to a dedicated closing coordinator, allowing for a streamlined process.

- An introductory email is immediately sent out to all parties outlining the critical dates and deadlines remaining in the transaction. The email is accompanied by electronic calendar reminders, to ensure no deadline, such as making a deposit or obtaining loan approval is missed.

- We’ll verify all deposits are timely made, and send a letter verifying so to all parties.

- We immediately perform a title search, determining if there are any liens, mortgages, or title defects on the property. If there are, our legal team begins resolving them.

- If the buyer is obtaining a loan, we immediately work with the lender to provide them the documentation they need to approve the financing, avoiding delays in the closing.

- If the property is in a condo or homeowners association, we’ll immediately contact the association to determine the property is in good standing. For instance, all maintenance fees are current.

- Our legal team will review all documents prepared by the seller’s attorney, such as the deed, to ensure all legal requirements are satisfied. If the seller does not have an attorney, we can prepare the documents for them.

- We prepare the final closing statement, which is an explanation of closing costs, and is similar to preliminary closing statements you’ll have already seen throughout the transaction. Our legal team reviews the closing statement to ensure proper allocation of closing costs amongst the parties prior to our review and thorough explanation of all costs with the buyer.

- Final closing is scheduled at any of our offices or wherever is most convenient for the client.

- At closing, all documents are thoroughly explained. Any liens or title defects have now been cured and a final title insurance policy is issued protecting the buyer.

- Before, during, and after closing we are here and always available to answer questions or assist in any way we can.

Immediately upon receipt of a contract, the process begins:

- Your file is assigned to a dedicated closing coordinator, allowing for a streamlined process.

- An introductory email is immediately sent out to all parties outlining the critical dates and deadlines remaining in the transaction. The email is accompanied by electronic calendar reminders, to ensure no deadline, such as making a deposit or obtaining loan approval is missed.

- We’ll verify all deposits are timely made, and send a letter verifying so to all parties.

- We immediately perform a title search, determining if there are any liens, mortgages, or title defects on the property. If there are, our legal team begins resolving them.

- If the buyer is obtaining a loan, we immediately work with the lender to provide them the documentation they need to approve the financing, avoiding delays in the closing.

- If the property is in a condo or homeowners association, we’ll immediately contact the association to determine the property is in good standing. For instance, all maintenance fees are current.

- Our legal team will review all documents prepared by the seller’s attorney, such as the deed, to ensure all legal requirements are satisfied. If the seller does not have an attorney, we can prepare the documents for them.

- We prepare the final closing statement, which is an explanation of closing costs, and is similar to preliminary closing statements you’ll have already seen throughout the transaction. Our legal team reviews the closing statement to ensure proper allocation of closing costs amongst the parties prior to our review and thorough explanation of all costs with the buyer.

- Final closing is scheduled at any of our offices or wherever is most convenient for the client.

- At closing, all documents are thoroughly explained. Any liens or title defects have now been cured and a final title insurance policy is issued protecting the buyer.

- Before, during, and after closing we are here and always available to answer questions or assist in any way we can.

Immediately upon receipt of a contract the process begins:

- Your file is assigned to a dedicated closing coordinator, allowing for a streamlined process.

- An introductory email is immediately sent out to all parties outlining the critical dates and deadlines remaining in the transaction. The email is accompanied by electronic calendar reminders, to ensure no deadline, such as making a deposit or obtaining loan approval is missed.

- We’ll verify all deposits are timely made, and send a letter verifying so to all parties.

- We immediately perform a title search, determining if there are any liens, mortgages, or title defects on the property. If there are, our legal team begins resolving them.

- If the buyer is obtaining a loan, we immediately work with the lender to provide them the documentation they need to approve the financing, avoiding delays in the closing.

- If the property is in a condo or homeowners association, we’ll immediately contact the association to determine the property is in good standing. For instance, all maintenance fees are current.

- Our legal team will review all documents prepared by the seller’s attorney, such as the deed, to ensure all legal requirements are satisfied. If the seller does not have an attorney, we can prepare the documents for them.

- We prepare the final closing statement, which is an explanation of closing costs, and is similar to preliminary closing statements you’ll have already seen throughout the transaction. Our legal team reviews the closing statement to ensure proper allocation of closing costs amongst the parties prior to our review and thorough explanation of all costs with the buyer.

- Final closing is scheduled at any of our offices or wherever is most convenient for the client.

- At closing, all documents are thoroughly explained. Any liens or title defects have now been cured and a final title insurance policy is issued protecting the buyer.

- Before, during, and after closing we are here and always available to answer questions or assist in any way we can.